Why Apartments

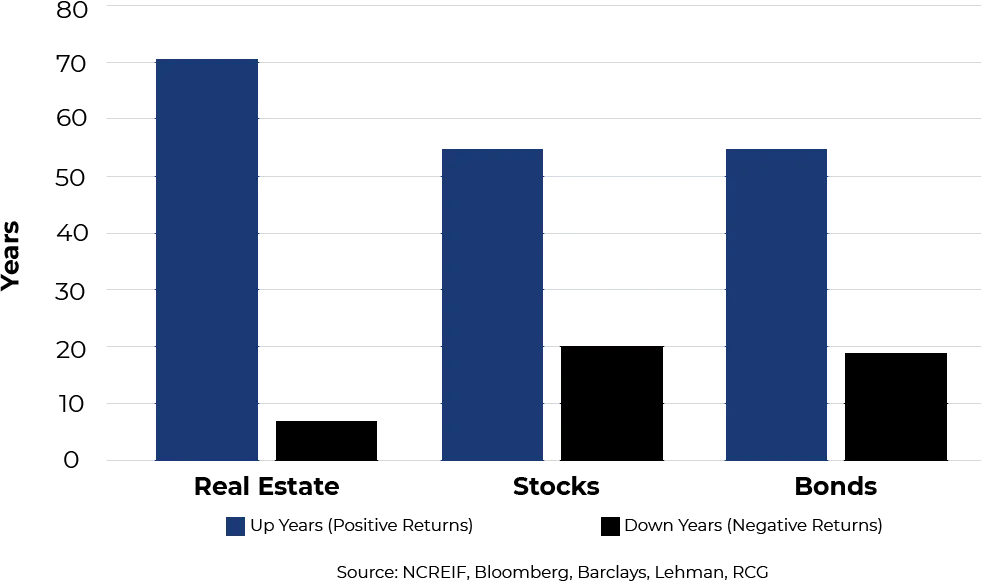

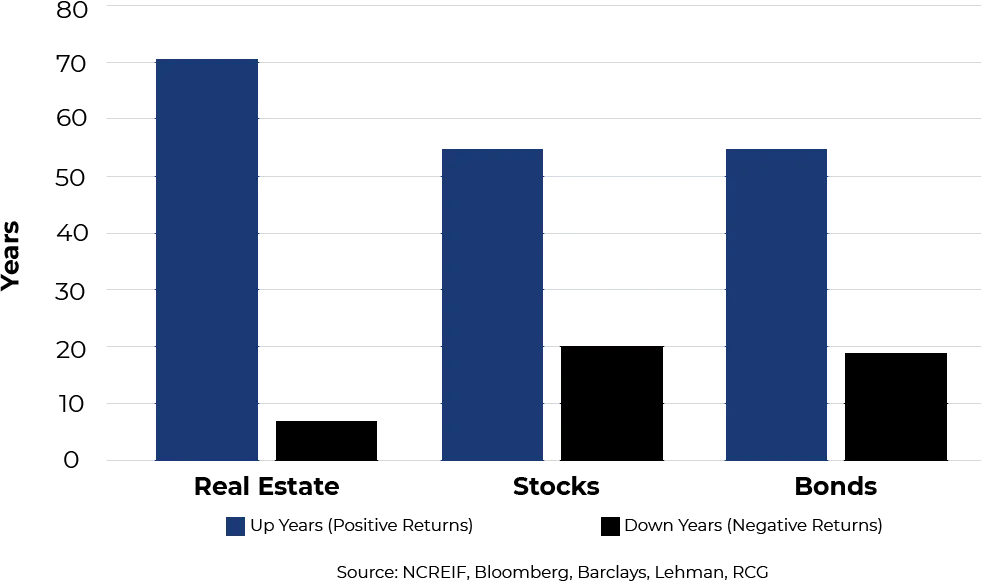

Apartments have historically outperformed stocks & bonds

Investing in apartments is a smart move for those who want to avoid high-risk investments. Not only can multifamily investments bring fantastic equity growth but can provide monthly income that can be greater than what you would get from stocks and bonds, making it an even better choice if your goal is maximizing returns on investment while minimizing risk within your portfolio.

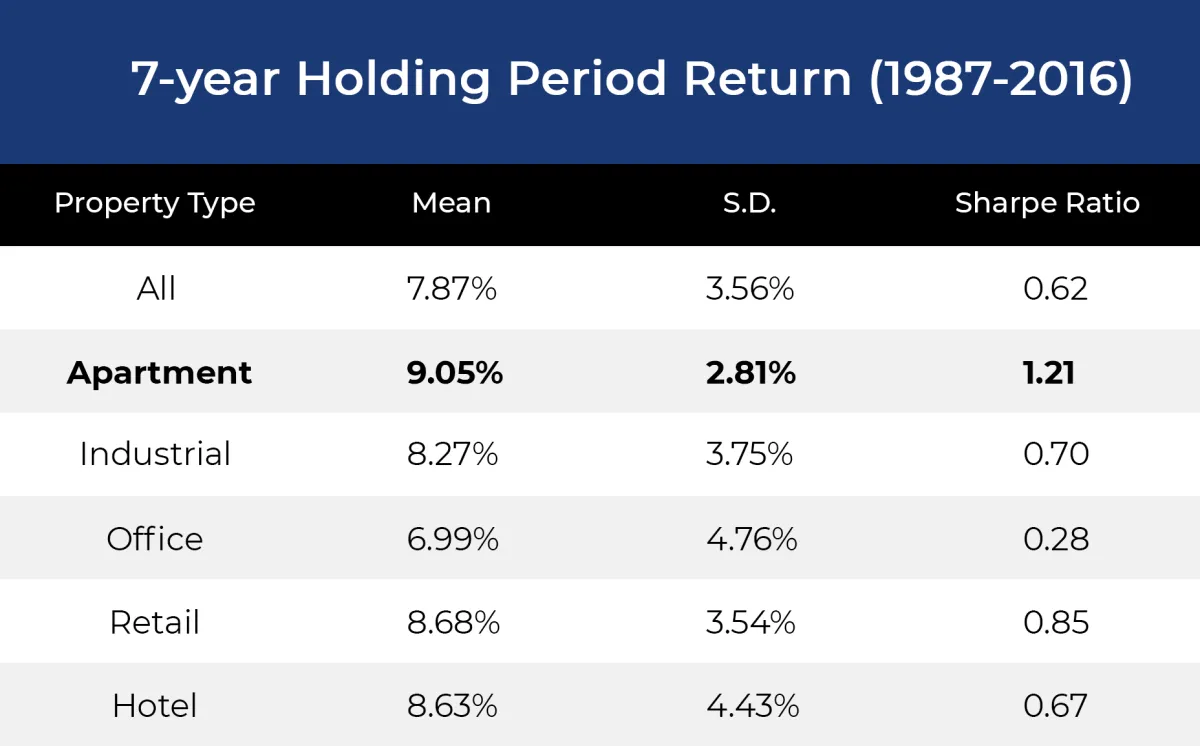

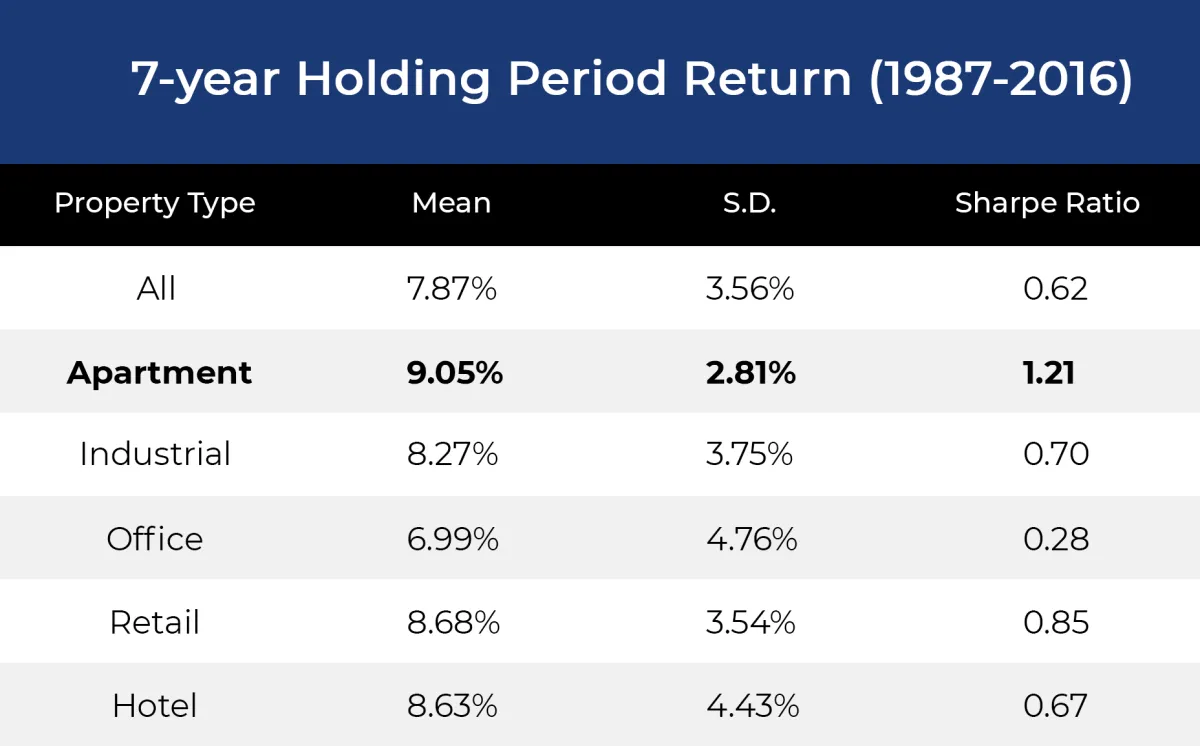

Apartments have historically outperformed other real estate asset classes

Apartments have also been the best investment amongst all other Real Estate Classes. Due to the nature of multifamily properties and because of the way we structure our investment properties, we are able to produce significant cashflow and equity growth, yielding higher overall returns than all other real estate asset classes.

Why Apartments

Apartments have historically outperformed stocks & bonds

Investing in apartments is a smart move for those who want to avoid high-risk investments. Not only can multifamily investments bring fantastic equity growth but can provide monthly income that can be greater than what you would get from stocks and bonds, making it an even better choice if your goal is maximizing returns on investment while minimizing risk within your portfolio.

Apartments have historically outperformed other real estate asset classes

Apartments have also been the best investment amongst all other Real Estate Classes. Due to the nature of multifamily properties and because of the way we structure our investment properties, we are able to produce significant cashflow and equity growth, yielding higher overall returns than all other real estate asset classes.

Take Advantage of Increased Tax Benefits

Our Team only acquires stabilized (above 80% occupancy) and cash flow positive apartment building investments. This allows our investors to make healthy returns while showing a loss at the end of every year.

Take advantage of 3 types of depreciation that allow investors to lower taxes:

- Standard or Straight-line Depreciations

- Accelerated Depreciation

- Bonus Depreciation

Cost segregation studies are performed on all of our assets and the tax benefits pass through to our investors via annual year end reporting on K1s that are issued for the preceding year.

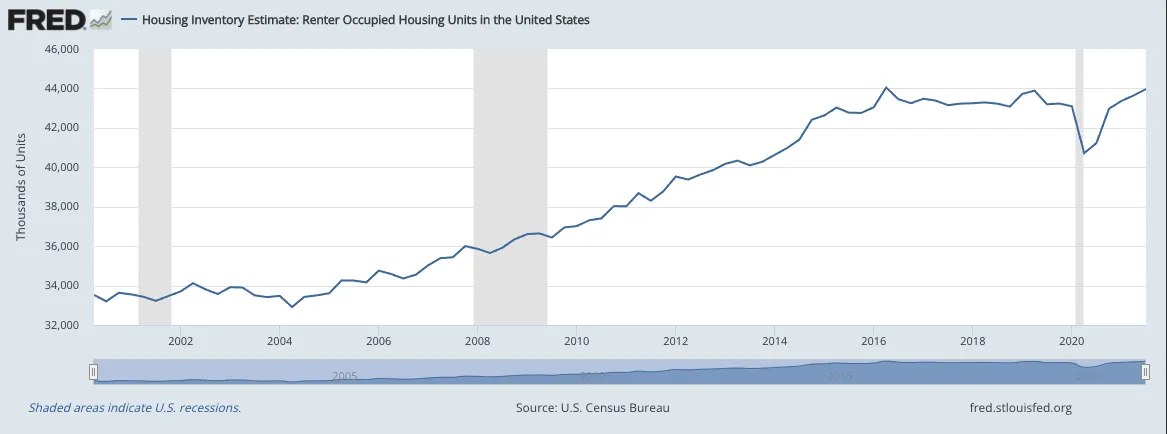

Demand for apartments is at an all-time high and still climbing

Since its peak in the mid-2000s, homeownership has been significantly dropping and it will continue to drop as millennials and the aging baby boomers want to stay mobile in the 21st century. With demand for apartments is at an all-time high, population is continuing to increase which drives the demand for apartment living higher and higher. Low vacancy rates equal greater cashflow as well as equity growth, which translates to higher returns for our investors.

Commonly Asked Questions

How do I get started in multifamily investing?

Investing in multifamily properties can be lucrative, providing cash flow, tax benefits, and potential appreciation. If you're considering investing in multifamily real estate, here are a few steps to get you started:

1. Set your investment goals: Determine your investment objectives, such as the desired return on investment (ROI), cash flow, and long-term appreciation. Are you looking for cash flow to supplement your paycheck, are you looking to enhance your retirement fund, or maybe you want generational wealth for your family?

2. Define your budget: How much are you willing to invest to get started? Different offerings have different minimums. The larger your investment, the greater your return.

3. Find a team of professionals: Engage professionals experienced in real estate and multifamily investments, like GT Capital Management. Their team and network of attorneys, accountants, property managers, and contractors will help guide the investment on the best path to meet the financial goals of the investment.

4. Monitor and optimize: Ensure that the team you invest with will provide regular property performance updates and financials. Consider their mission and whether it aligns with your vision. Are they trustworthy and transparent?

Remember, investing in multifamily properties involves risks, and it's important to conduct thorough research, speak with professionals, and carefully assess each opportunity before committing your capital. Contact us anytime to learn more.

How much do I have to invest?

The average investment into multifamily properties can vary significantly depending on various factors such as the location, size of the property, condition, and market conditions. That being said, multifamily properties are typically considered commercial real estate, and the investment amounts tend to be higher compared to residential real estate investments. It's not uncommon for multifamily property investments to range from hundreds of thousands to millions of dollars.

Ultimately, the specific investment amount into multifamily properties will depend on the investor's financial capabilities, risk tolerance, investment strategy, and market conditions. Each offering has a different minimum investment amount and it's important to conduct thorough financial analysis to determine the potential returns and risks associated with a multifamily property investment before committing capital.

Demand for apartments is at an all-time high and still climbing

Since its peak in the mid-2000s, homeownership has been significantly dropping and it will continue to drop as millennials and the aging baby boomers want to stay mobile in the 21st century. With demand for apartments is at an all-time high, population is continuing to increase which drives the demand for apartment living higher and higher. Low vacancy rates equal greater cashflow as well as equity growth, which translates to higher returns for our investors.

See for yourself why investors love working with us!

See for yourself why Investors love working with us!

@ 2019 All Rights Reserved. Privacy Policy | Terms of Use